We strive for fair, competitive compensation for our team members adjusted annually for their regional basis.

Salary Appraisals have their page.

Compensation & Terminology References

This section should help you better understand the terms used regarding salaries at Axelerant. It’s generalized information, and not all allowances or benefits apply to Axelerant team members unless documented explicitly in relevant guidances like Benefits.

Cost To Company (CTC)

The Cost to Company or CTC is the amount that an employer expends in hiring the service of an employee. The CTC includes all the elements of a salary structure - Basic Salary, House Rent Allowance (HRA), Basic Allowance, Travel Allowance, Medical, Communication, Provident Fund, Pension Fund, etc., incentives or variables pay. CTC and take-home salary vary as CTC represents direct, indirect, and savings contributions. Direct benefits may include basic salary, conveyance allowance, medical allowance, house rent allowance, communication allowance, etc. Indirect benefits include food coupons, income tax savings, subsidized meals, etc. The savings contributions include - Superannuation Benefit, Employee Provident Fund, Gratuity, etc.

Gross Salary

Subtract gratuity and the employee provident fund (EPF) from Cost to Company (CTC); the amount you get is your Gross Salary. You earn the amount before deducting income taxes and other deductions such as bonuses, overtime pay, holiday pay, etc.

Basic Salary

Your basic salary is one of the components of your salary and is mentioned in the salary breakup/structure. The entire amount of your basic salary is included in your take-home salary.

Net Salary or Take Home Salary

As the name suggests, take-home salary is the amount credited to your salary account every month. The employer gives it after deducting taxes and other deductions such as public provident fund, professional tax subtraction, etc.

What is salaried income?

The income received by an employee from an employer in cash, kind, or as a facility is considered as salary.

What are allowances?

Allowances are fixed periodic amounts, apart from salary, paid by an employer to the employee—for example - tiffin allowance, transport allowance, uniform allowance, etc.

What are the different types of allowances?

There are generally three types of allowances for the Income-tax Act - taxable allowances, fully exempted allowances, and partially exempted allowances.

Is pension income taxed as salary income?

Yes. However, the pension received from the United Nations Organisation is exempt.

What is Axelerant’s annual CTC breakdown?

See the Annual CTC Breakdown spreadsheet to determine yours.

Salary Ranges

Salary ranges are primarily used during new team members hired to establish a fair compensation point of entry considering Axelerant’s current people. Therefore, even after a salary appraisal, when current team members are below the updated salary range or otherwise misaligned, their salary will be adjusted within the salary range.

See Salary Ranges 2021-22 for specifics.

Defining Salary Ranges

Salary ranges or brackets are intended to provide fair and equity starting points for new hires, promotions, and lateral transfers for current team members. After role and level salary range creation, they’re reviewed by People Ops and relevant leadership during the last quarter of each fiscal year for the following fiscal year.

Salary ranges are typically researched using https://careernavigator.naukri.com/ or https://www.payscale.com/. Regional-specific roles may use location-specific resources to support a just starting salary bracket.

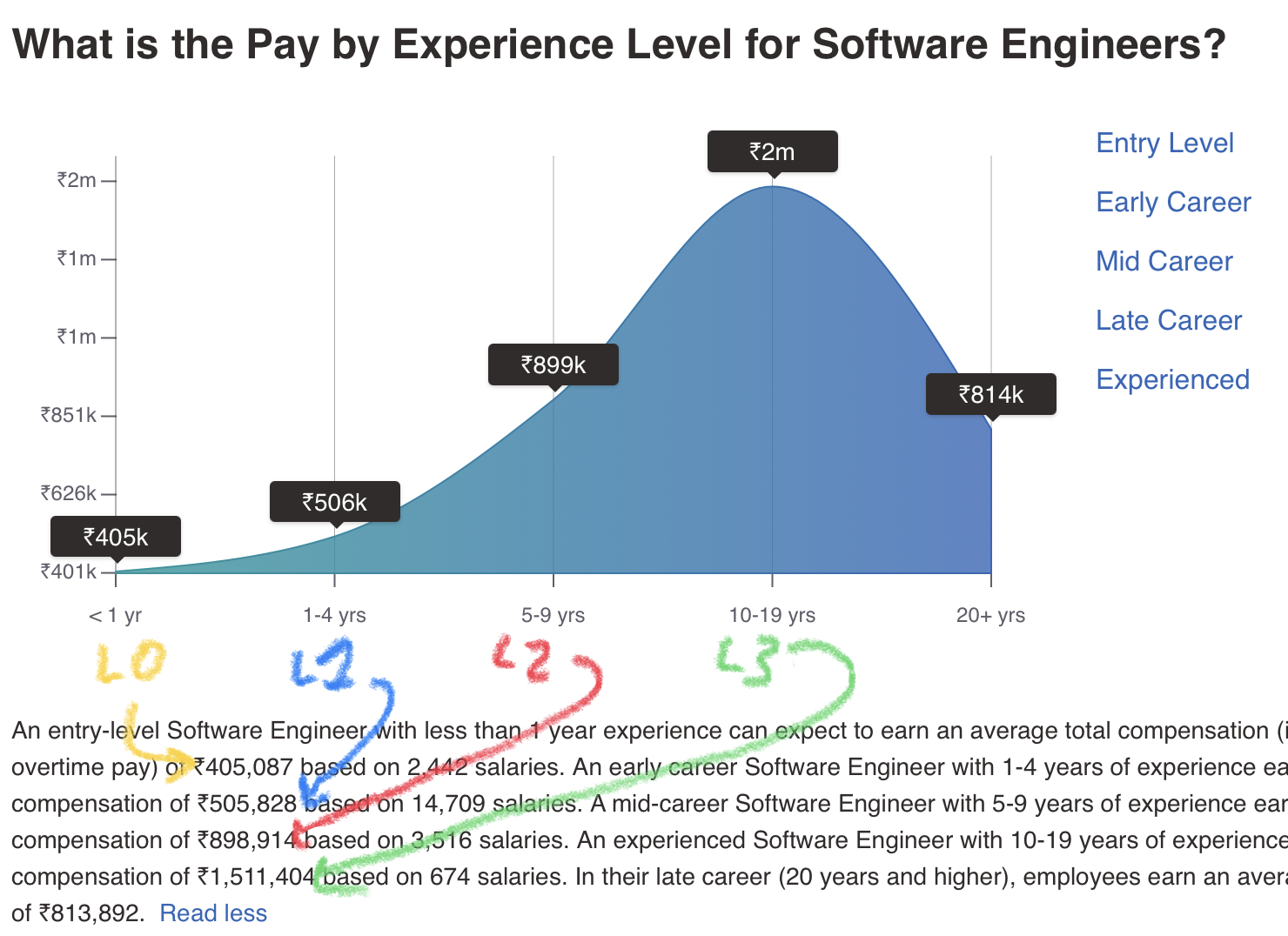

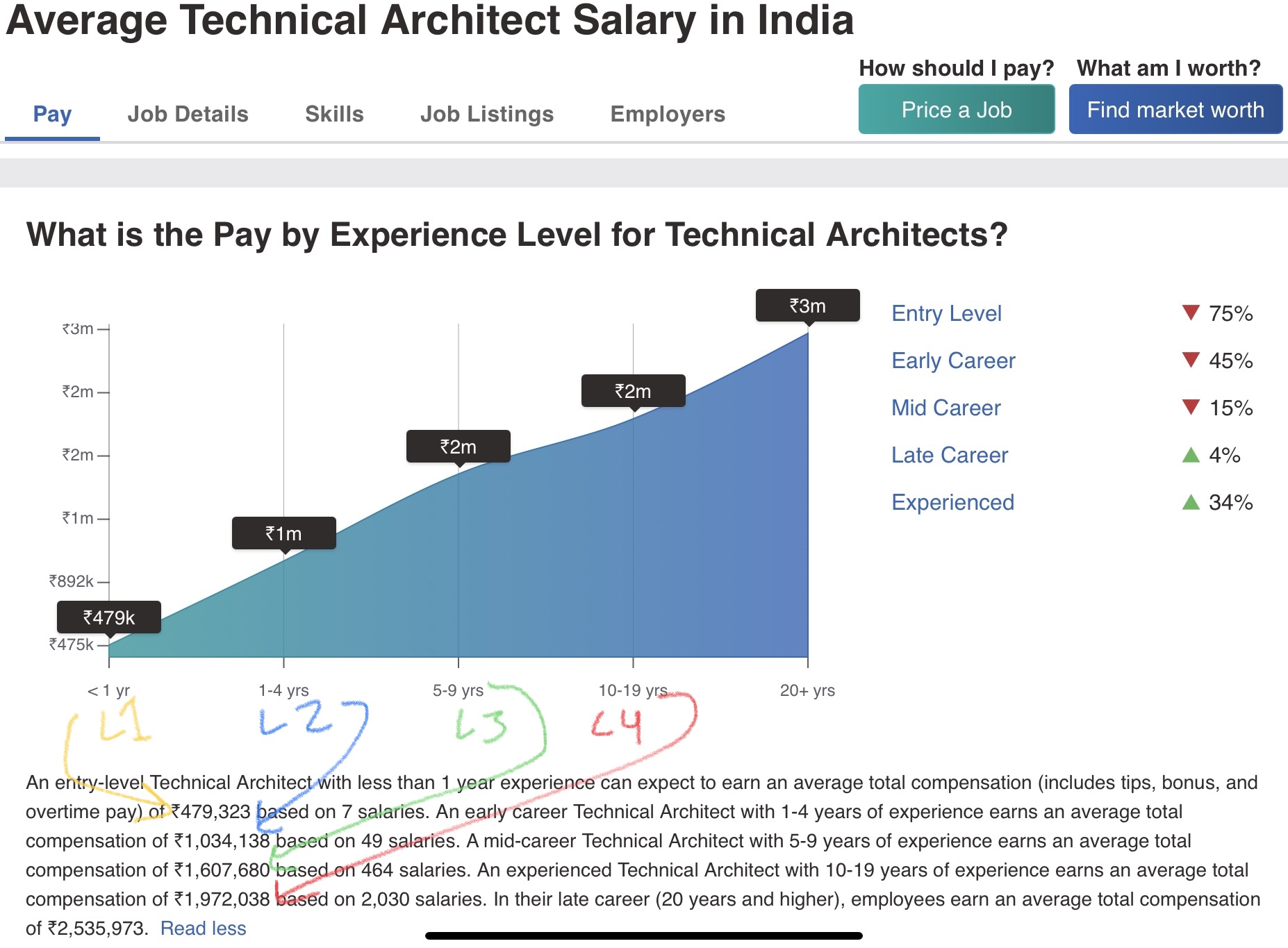

When using PayScale, we find its most closely relevant role, then identify the most pertinent average Pay by Experience Level. The number found is then used as the role and level baseline with corresponding percentiles of the average, -25% and +50%, to bracket salary range beginning and endpoints by default.

A 100% average percentile reflects paying twice the market average for awareness.

Role - Basic | Role - Advanced | PayScale - Pay by Experience Level |

|---|---|---|

L0 | <1 yr | |

L1 | 1-4 yrs | |

L2 | L3 | 5-9 yrs |

L3 | L4 | 10-19 yrs |

L5 | 20+ yrs |

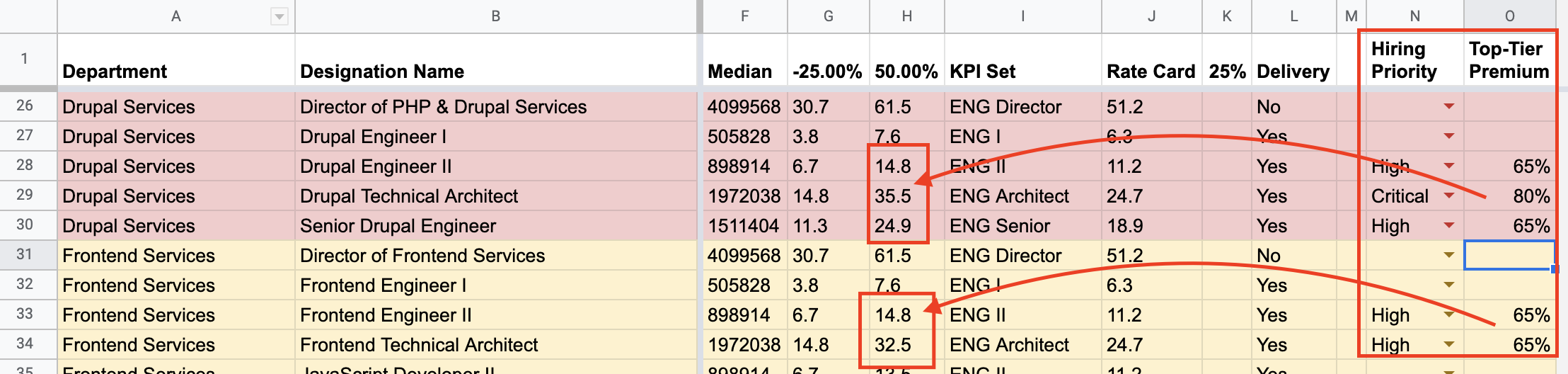

E.g., For a fundamental role like Senior Drupal Engineer, we look up Software Engineer via https://www.payscale.com/research/IN/Job=Software_Engineer/Salary, scroll the page down, look for the equivalent L3 experience point of 10-19 years and see that 1,511,404 INR is the average salary that we’ll use for our corresponding salary bracket baseline.

E.g., For an advanced role like Drupal Staff Engineer, we look up Staff Engineer via https://www.payscale.com/research/IN/Job=Technical_Architect/Salary, scroll the page down, look for the equivalent L4 experience point of 10-19 years and see that 1,972,038 INR is the average salary that we’ll use for our corresponding salary bracket baseline.

Premium Role Salary Range Adjustments

Though Axelerant’s salary ranges are very competitive, we can’t deny that the kind of people we want are remarkable and other companies recognize them as such. For some roles, we have a Top-Tier Premium associated with their hiring priority in which the top-end of its salary range is relatively increased.

High adds 10% to the salary range top-end via 65% average percentile

Critical adds 20% to the salary range top-end via 80% average percentile

By default, top-tier is defined as the 50% average percentile. More at Defining Salary Ranges.

The relevant hiring and recruitment team is responsible for applying a role premium.